As a business owner in Georgia, one of the most important things you should consider is building business credit. It allows you to get the funds you need for your business. In this article, we’ll tackle the importance of building business credit in Georgia and how to do it.

What is business credit?

Business credit is a company’s record of credits that are used by banks, suppliers, and lenders to assess a company’s ability to pay debts. This record can be acquired from credit agencies such as Equifax Small Business, Experian Business, and D&B.

A business credit report includes a company’s information, loans, payment transactions, credit usage and limit, and credit score. It also includes public information such as bankruptcies and UCC filings.

Therefore, it contains important data on a company’s financial status and creditworthiness.

What is business credit used for?

Having business credit is useful to a company in many ways. Such as:

- It allows a business to get a large amount of money with lower interest rates.

- It protects your personal credit records in case the business fail.

- It allows a business to get a loan even if you, as the owner, have a bad credit score.

- It allows a company to get the best business insurance available.

- It allows the business to enter a partnership contract with other companies for much more growth.

A Step-by-Step Guide on How to Build Business Credit in Georgia

Step 1: Establish Your Business Legally

The first step to building business credit in Georgia is legalizing it. This includes registering your business name, getting a business phone number, licenses, EIN, D&B Number, etc. Without obtaining these, acquiring loans can be difficult.

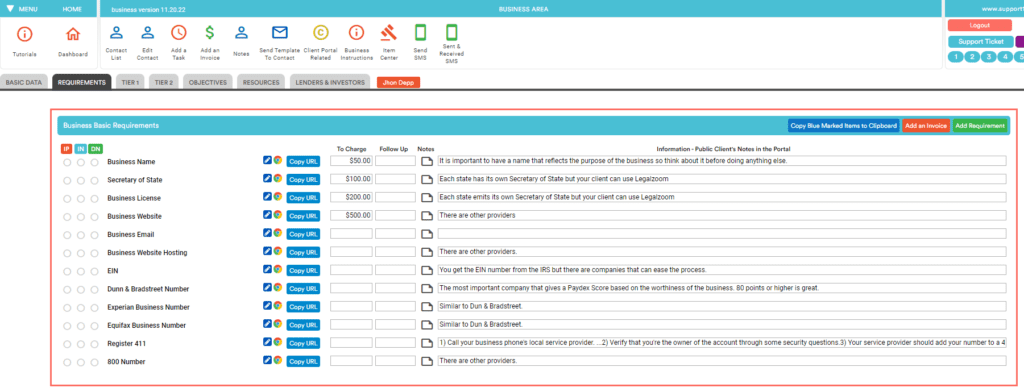

One of the easiest ways to ensure you get all the requirements needed to build credit is by using the Business Requirement Tool of Business Credit Machine, a business credit builder software. It’ll guide you through how to obtain all the needed requirements.

This is a screenshot from the Business Requirement Tool of BCM.

Tip: When registering your business with the Secretary of State, it is recommended to use a proper business structure. Such as LLC, LLP, or corporation. This is necessary to make your business is an independent legal entity. This would allow your business to have a separate credit record from your account. Doing this will protect you from being accountable in case your business fails or suffers from debt.

For instance, creditors will not be allowed to compensate your personal belongings as payment for your unpaid business debts. Registering your business as an LLC, LLP, or corporation, will also allow you to get business loans even if you have a bad personal credit score.

Cost of Business Filings in Georgia

The table below is the filing fees for domestic LLC, LLP, and Corporation.

| Services | Fees |

| Online Filing | $100 |

| Paper Filing | $110 |

| Two Days Expedited Filing | $100 |

| Same Day Expedited Filing | $250 |

| 1 Hour Expedited Filing | $1000 |

Business Filing fees in the Secretary of State Georgia cost $100 for online filing or $110 for paper filing. This price is for LLC, LLP, or Corporation. For expedited filings, fees are $100 for two business days expedited service, $250 for the same day expedited service, or $1000 for an hour expedited service. The expedited fee is in addition to the regular filing fee associated with the document type or service requested.

You may be required to pay for other services such as $25 for a 30-day name reservation and $10 for a certified copy of documents. You may refer to Georgia Business Division Filing Fees page to see more information about the Secretary of State’s filing fees.

Step 2: Open a bank account for your business

Once you have legalized and established your business, use your legal business information to open a bank account. Having bank records of your business transaction is important because creditors will check them when you apply for a business loan.

Tip: Avoid using your business bank account for personal transactions so it’s easy to track business expenses and income. Additionally, it to know if your business is generating enough income to sustain and grow.

Step 3: Get a business credit card

Getting a business is the easiest way to start building business credit in Georgia. It does require much and offers many benefits. Just like low APR rate as a new account, cashback, and rewards. It also offers a larger credit limit than personal cc. So, you can get more supplies for your business while building credit at the same time.

Tip: Avoid getting multiple business credit cards all at once. The benefits might be mind-boggling but it is not recommended to get many business cards within several months. This signals to the credit bureaus that your business is relying on credit cards to sustain. As a result, your business credit score will decrease. You don’t want that especially when you are still establishing credit.

Step 4: Establish credit lines with suppliers and traders

Obtain your materials and needed services from vendors who submit reports to major credit bureaus. Confer with your suppliers if they are open to providing you with a Net-30 or Net-15 account. This simply means getting their items or services in advance and having to pay for them within 30 or 15 days. This tactic is an efficient way to build business credit fast.

Tip: Always ask vendors if they report to major credit bureaus before making transactions to make sure you are building credit when creating credit accounts with them. This is important as not all vendors submit reports to credit bureaus.

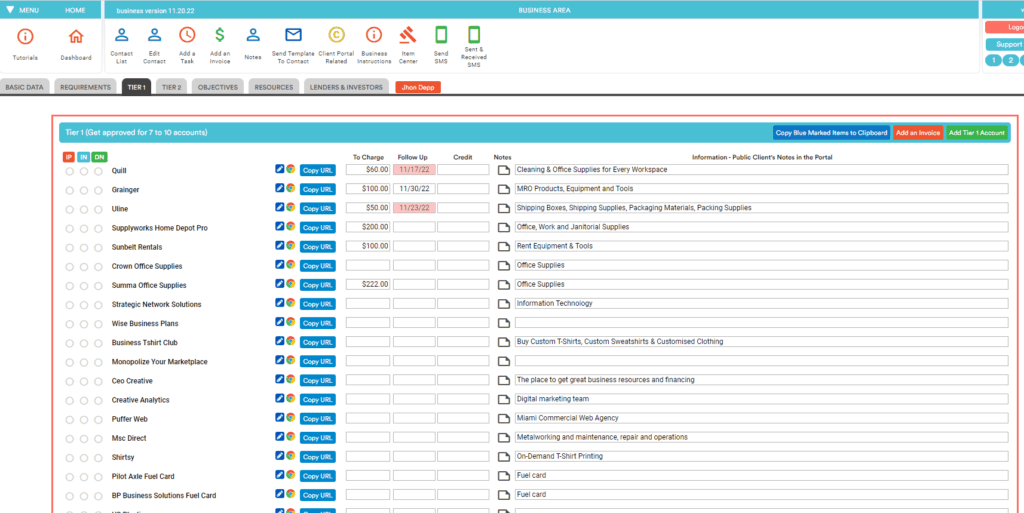

If you have Business Credit Machine, you can easily apply credits to reputable vendors with its creditor database. You simply have to go to the Business Area and Choose Tier 1 or Tier 2.

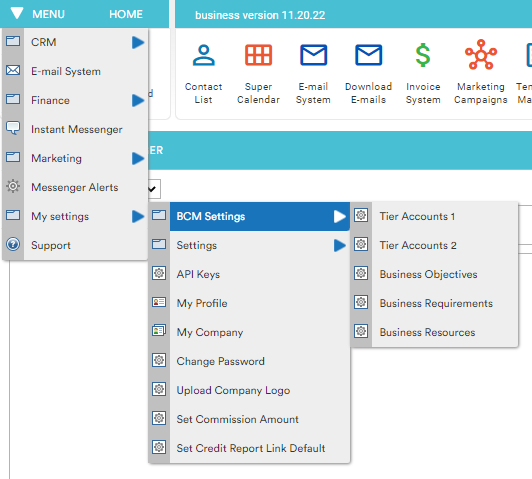

If you wish to add more lenders that are not on the list, you can do so by clicking the Menu, then scrolling down to My Setting and BCM Setting then choosing where to save it, Tier 1 or Tier 2.

Step 5: Pay your debts early

All your efforts in building business credit will only go to waste if, in the end, you’ll have a bad credit score. Ensure that you’re on your way to building a very good company credit score by keeping track of your due dates and paying your bills on time. Avoid paying late at all costs, even just for a day, as it will appear on your business credit reports for up to seven years.

Remember that credit history is a big factor in evaluating credit scores and vendors’ decisions when approving loans. Lenders may hesitate to approve your loans knowing that you have bad records of not paying your obligations on time. Moreover, once your business credit score drops due to late payments, it can be hard to retrieve.

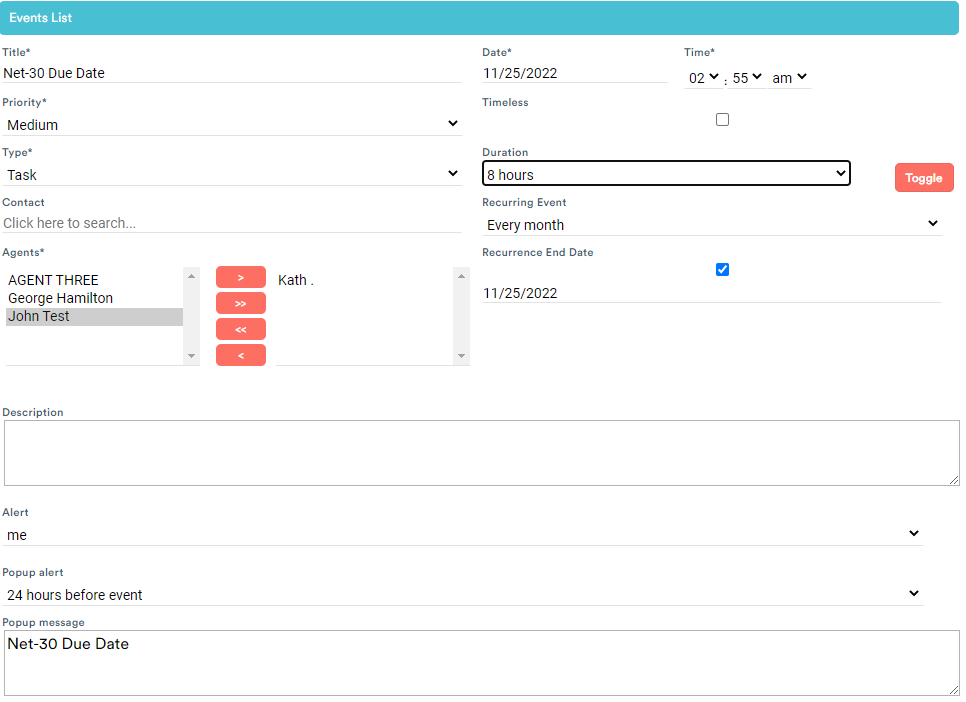

With the use of Business Credit Machine, you can ensure to pay bills on time by setting events to notify you a few days before your due date.

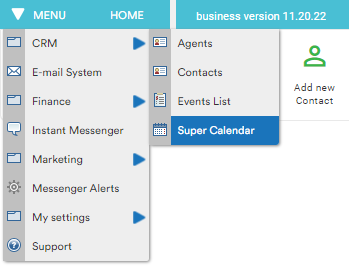

From the dashboard, click on Menu, CRM, then Super Calendar to set an event.

See this image as an example.

Step 6: Record your company’s credit health

Tracking your business credit scores is the best way to ensure you are building an excellent business credit score.

Here are some reasons why monitoring your business credit score is very important when building business credit in Georgia.

- Monitor the alterations in your business credit reports and identify any errors.

- Verify if the loan companies you apply for credit are submitting to credit bureaus.

- See who is looking at your credit records.

- Avoid identity theft by reporting unauthorized queries of your credit records.

- Correct errors in your business credit reports by identifying delinquencies and disputing them with the credit bureaus at the earliest opportunity. This method might take several months or perhaps a year depending on the type and number of mistakes that need to be fixed.

For these reasons, monitoring your company credit reports is important to ensure that the document is accurate and complete. Any mistakes in the credit reports can reduce credit scores and that’s the last thing you want when building business credit.

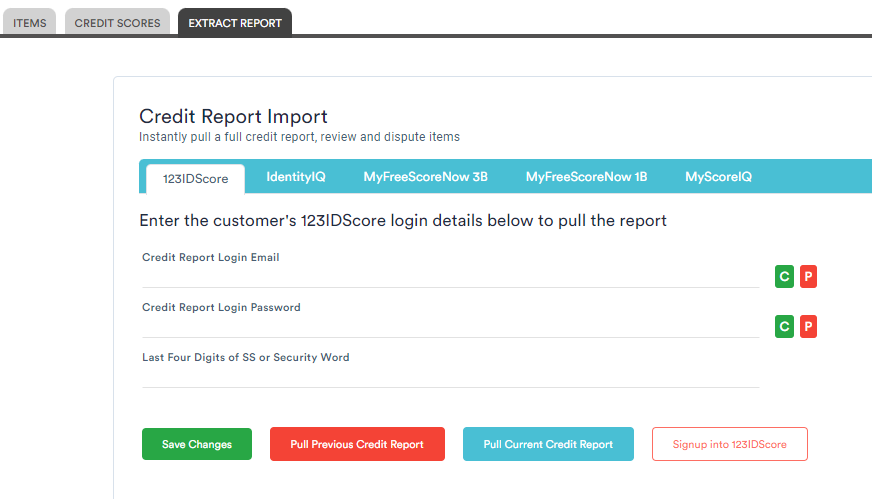

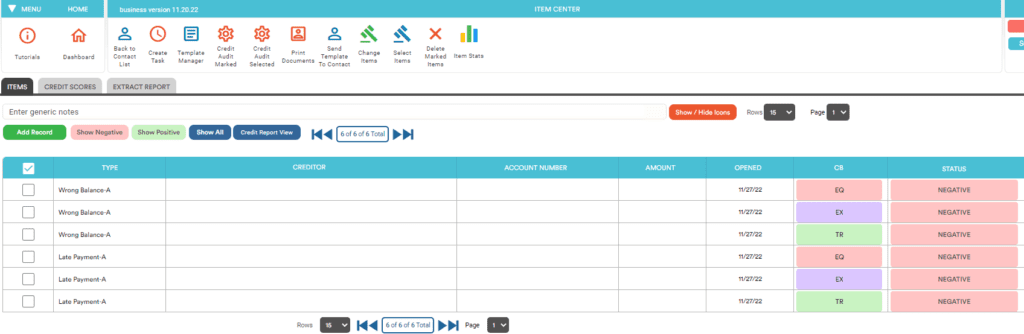

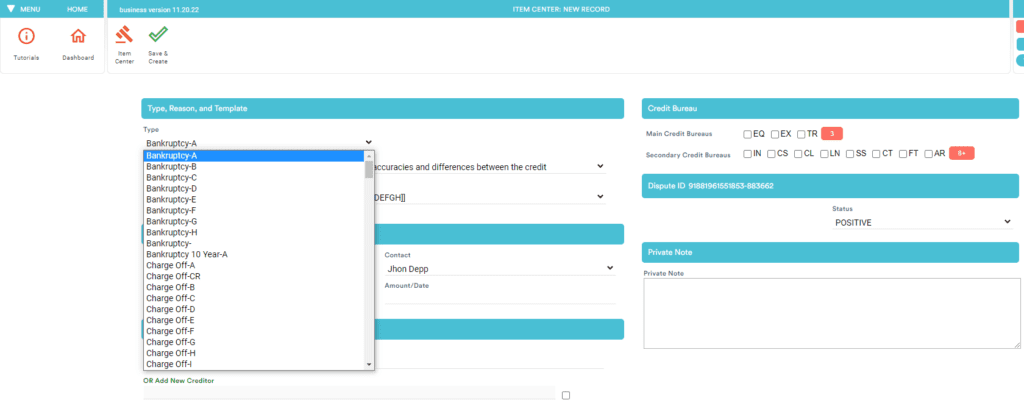

It is suggested to review credit regularly. If you have Business Credit Machine, you can extract and review your business credit records any time you want inside the Item Center.

Just go to the Extract Report tab to pull credit reports in your preferred credit reporting site.

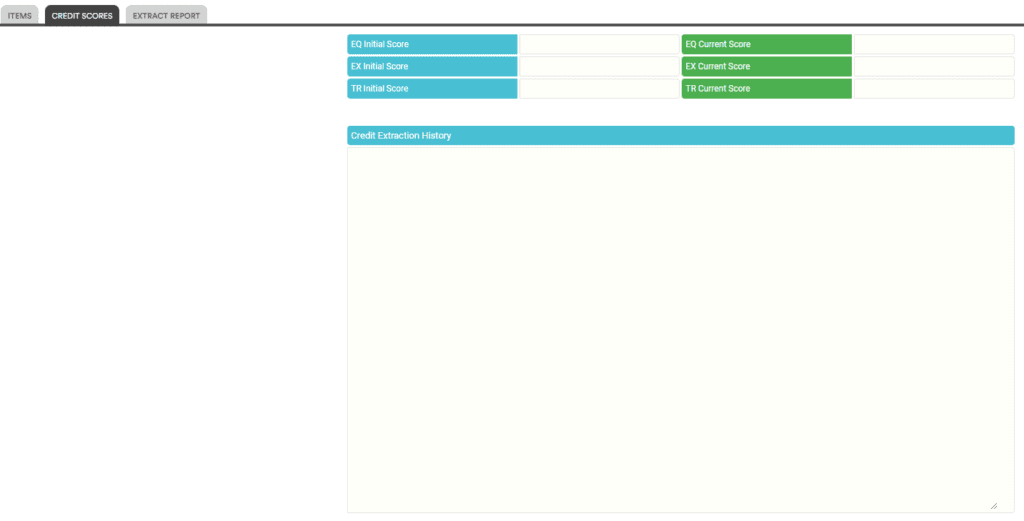

In the Credit Scores tab, you can easily keep an eye on your credit scores.

In the Credit Scores tab, you can easily keep an eye on your credit scores.

You can add an item by simply clicking the Add Record button. To filter the list, you can choose Show negative or show positive button. Fill up the form and select dispute type, reason, and template in the drop-down list.

Business Credit Machine is an all-in-one business credit builder software that does not only build credit but also works as a CRM program, marketing program, and sales program. Features that are very useful for running and growing a business. Check out Business Credit Machine – The Best Business Credit Builder Software to learn more about its amazing features.

Now that you have a good understanding of how to build business credit in Georgia, here are a few more articles about credit building that you may find helpful.

Recent Comments